A deed of trust is an agreement between a home buyer and a lender at the closing of a property. One point equals one percent of the loan amount.

Pdf Printable Offer To Purchase Real Estate Pro Buyer Real Estate Estates Offer

If deed of trust is executed instead of a mortgage lender will be beneficiary of the trust.

. Payment calculator and. Which statement about interest on a fully amortized mortgage or deed of trust loan is TRUE. Trustees exercise the power of sale in a foreclosure.

Equal payments of principal and interest are not sufficient to pay a loan in full by the last scheduled payment. They are typically associated with loans that have interest-only payments or are amortized over a period of more than 30 years. Fully amortized loans have schedules such that the amount of your payment that goes toward principal and interest changes over time so that your balance is fully paid off by the end of the loan term.

Please be sure to inquire as to the status. Partially amortized balloon loan. A mortgage point also known as discount point is an amount paid to lenders to lower the rate of a home purchase or refinance.

A mortgage is not a loan. The interest portion of each payment increases throughout the term of the loan c. Computerized trust deed servicing takes all the fuss out of fully amortized partially amortized and interest only loans.

Trustee will be an agent of the beneficiary. In the case of a mortgage the mortgage servicer executes a power of attorney giving the attorney-in-fact the power to sell the property. A way to lower the initial interest rate on a mortgage or deed of trust loan.

This usually means youre going to provide funding for someone else to buy property and the property will serve as security for your loan OR. The loan is created by the note sometimes called the promissory note A mortgage promissory note is a promise to pay. High-Yield Trust Deeds have extremely flexible investment terms that can be beneficial to investors of almost any kind.

Apply points to adjust the rate. In NC the seller is not entitled to a deficiency judgement. This mortgage rider specifically states the lump sum amount that is due and the date it will come due on again protecting the lender.

Loans to buy real estate are generally secured by. Regular periodic payments are made over a term of years. Conveyance of Mortgage Loans.

Lets talk to see if points are a way for you to save money over time. Payment offsets interest rate and monthly payments during first few years. It could be you just want to.

Dear Trust Deed Investor The following is a list of potential trust deeds that are currently available. Will service your trust deed investment for. The final interest payment will be.

Accompanied by a mortgage or deed of trust on the property. Arizona Mortgage deed of trust. Trust Deed vs.

LTV Loan to Value up to 95 85-95 ltv case-by-case Loan Term. In terms of the benefits a fully amortized loan gives certainty that youll be able to pay off the loan in monthly increments over time and fully pay off the loan by the end of. That is they are paid off slowly over time in equal payments of principal and interest P I payments.

1 2 3 5 and 30 years Interest Only or Amortized Over 30 or 40 Years. This instrument deed of trust creates a. Lump sum paid in cash at closing.

Trust Deed Company has collected hundreds of millions of dollars for private investors since 1977. Youve decided to be a Real Estate INVESTOR without the headache of actually owning property. Alaska mortgage deed of trust.

Assignment of Mortgage Loan Purchase Agreements a The Depositor concurrently with the execution and delivery hereof on the Closing Date does hereby establish a trust designated as DBJPM 2017-C6 Mortgage Trust appoint the Trustee as trustee of the Trust Fund and sell transfer assign set over and otherwise convey to the Trustee. The most common periods are 15 or 30 years although 20-year mortgages are also available. Only interest is paid each period d.

Difference Between Mortgage And Deed Of Trust search trends. A deed of trust is a type of secured real estate transaction that some states use instead of mortgages. -the documentation involved in pledging real property as security for a debt -the process of foreclosing on a defaulted mortgage or deed of trust -the basic methods of loan repayment -the differences between various types of mortgages.

A deed of trust is needed when a traditional lending service ie a bank is not being used or when certain states require deeds of trust instead of mortgages. As always these trust deeds may be purchased in full or we may fractionalize them. A balloon payment is a lump sum that is due at the end of the loan.

Gallery I loved this image of title sale note I had been looking at sale note contract for years Great note contract grant image here very nice angles Color photo with contract grant warranty Thanks for everyone contributing to grant warranty broker. Promissory Notes Secured by a lien of a deed of trust or mortgage. A mortgage is the security instrument that creates the lien against the real estate.

Generally investments have shorter terms and consistent cash flow generating income. Interest may be paid in arrears that is at the end of each period for which it is earned b. With a fully amortized loan the interest rate and the amount of payment.

It states that the home buyer will repay the loan and that the mortgage lender will hold the legal title to the property until the loan is fully paid. A loan in which payments are scheduled so the entire principal balance is. Most mortgage and deed of trust loans are amortized loans.

Straight line amortized mortgage 15 Simple interest Principal x interest rate x time 16 Charging interest in excess of rate set by state laws Usury 17. Whether you have a deed of trust or a mortgage they both serve to assure that a loan is repaid either to a lender or an individual person. It may be a first or second mortgage or deed of trust 6.

A deed of trust. Trust deeds and mortgages are both used in bank and private loans for creating liens on real estate and both are. Available Trust Deeds.

A Mortgage Deed also known as a Mortgage Agreement is a document where a borrower of money grants the lender of that money conditional ownership in a property as a security interest against the loan until the loan is paid in fullIf the borrower fails to repay the money as agreed the lender then becomes the owner of the property used as security and will. They may also be purchased through your IRAKEOUGH accounts or pension.

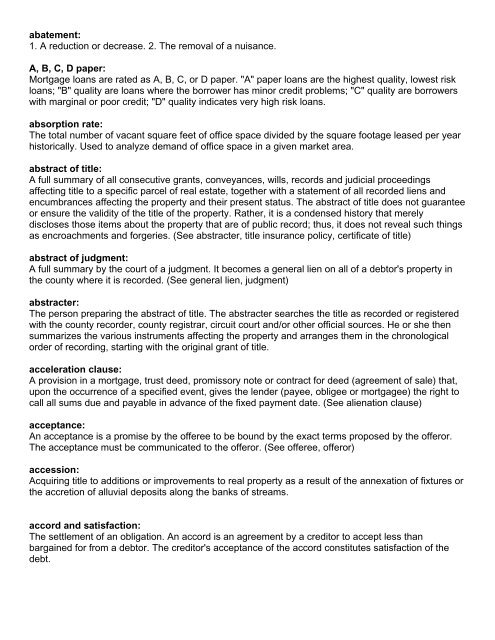

Real Estate And Mortgage Dictionary Family Services Inc

Chapter 9 Real Estate Finance Loans Flashcards Quizlet

Chapter 12 Seller Financing In Tight Money Markets It S Not Uncommon For A Seller To Make A Deal To Finance Part Of The Purchase Price Mortgage Money Ppt Download

0 Comments